[ad_1]

(Photo by Mario Tama/Getty Images)

President Joe Biden may as effectively change the nation’s title to the United States of Inflation because the newest client worth index (CPI) sizzled in November. Once once more, all the things turned dearer over the past month, buoyed by a historic financial growth, a worldwide provide chain disaster, and simultaneous demand worldwide. But low- and middle-income Americans struggling to make ends meet shouldn’t fear as a result of CNBC host Jim Cramer believes that is one of the best financial system he has ever seen So, let’s dive into the numbers and see how shoppers’ pockets are getting fleeced by this deadly tax we name inflation.

Bidenomics 101: Inflation Does Not Discriminate

The U.S. annual inflation charge surged to six.8% in November, up from 6.2% in October. This was barely larger than the median estimate of 6.7%. The CPI superior 0.8% on a month-over-month foundation, which was additionally greater than the 0.7% the market had penciled in forward of the much-anticipated report.

The core inflation charge, which removes the risky meals and vitality sectors, climbed 4.9% in November, matching economists’ projections. The core CPI rose 0.5% from the earlier month.

Overall, inflation has not been this excessive in 39 years. But the place are the worth pressures being felt? The Keynesian coquettish mistress doesn’t discriminate as the associated fee of residing was felt throughout the board in each sector of the financial system. Well, aside from potatoes, which dipped 0.2%.

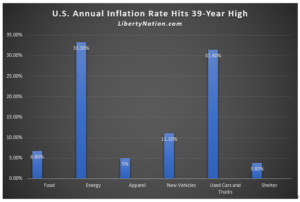

Here is a breakdown of worth inflation in comparison with the identical time a 12 months in the past:

- Food: +6.1%

- Energy: +33.3%

- New Vehicles: +11.1%

- Used Automobiles and Trucks: +31.4%

- Apparel: +5%

- Shelter: +3.4%

Within the meals expenditure class, shoppers spent 12.8% extra on meat, poultry, fish, and eggs. Dairy climbed 1.6%, whereas vegatables and fruits superior by 4%. It goes to price extra to be wholesome since apples soared 7.4%, bananas jumped 3.7%, oranges edged up 0.9%, and the “other fresh fruits” spiked 7.7%.

Within the meals expenditure class, shoppers spent 12.8% extra on meat, poultry, fish, and eggs. Dairy climbed 1.6%, whereas vegatables and fruits superior by 4%. It goes to price extra to be wholesome since apples soared 7.4%, bananas jumped 3.7%, oranges edged up 0.9%, and the “other fresh fruits” spiked 7.7%.

On the vitality entrance, gasoline oil skyrocketed 59.3%, motor gasoline elevated 58%, and electrical energy picked up 6.5%. Tenants wanting the luxurious of a roof over their heads paid 3.9% extra for lease. If you assume you may keep away from paying extra on your heating invoice by including layers, you may assume once more. In November, males’s attire was 7.6% larger, and ladies’s attire was 4.2% extra.

From dental providers to postage to funeral bills to checking accounts, each good and repair you would assume of within the market was costlier final month. And there aren’t any indicators that is slowing down.

How the Markets Responded

Unlike the emergence of the Omicron variant, the best inflation studying since 1982 didn’t spook the monetary markets. At the opening bell on December 10, the Dow Jones Industrial Average rose about 200 factors, the Nasdaq Composite Index rallied greater than 100 factors, and the S&P 500 tacked on 0.7%. The main benchmark indexes are poised for a profitable week.

The metals market, a traditional refuge from rampant worth inflation, was not ebullient: January gold futures added $8.50 to $1,785 an oz., and February silver futures tumbled under $22 per ounce. But cryptocurrencies, which monetary consultants debate is the brand new inflation hedge, rallied, with Bitcoin surging greater than $2,000 to just about $50,000. Ethereum additionally climbed 2.25% to shut to $4,200.

The metals market, a traditional refuge from rampant worth inflation, was not ebullient: January gold futures added $8.50 to $1,785 an oz., and February silver futures tumbled under $22 per ounce. But cryptocurrencies, which monetary consultants debate is the brand new inflation hedge, rallied, with Bitcoin surging greater than $2,000 to just about $50,000. Ethereum additionally climbed 2.25% to shut to $4,200.

The U.S. Treasury market was principally drowning in a sea of crimson ink, with the benchmark 10-year bond down 0.015% to 1.472%. The one-year invoice edged up 0.01% to 0.274%, whereas the 30-year bond dropped 0.02% to 1.846%.

What Next?

The Federal Reserve and the White House have deserted the time period “transitory” when describing inflation. They do insist, nevertheless, that inflation pressures will ease someday within the second half of 2022 simply in time for the mid-term elections. But this degree of optimism may not persuade the general public, particularly when President Biden’s approval score is caught at round 41%, together with 56% who disapprove of his financial report. Will the close to four-decade-high inflation be sufficient for the Washington institution to hit the pause button on huge spending, borrowing, and printing? Bidenomics and its offspring, the Build Back Better agenda, require the federal government to spend, borrow, and print trillions of {dollars} and not using a care on this planet. It is simply too unhealthy the American folks will undergo for the Biden administration’s big-government paternalism and recklessness.

~ Read extra from Andrew Moran.

[ad_2]

Source hyperlink